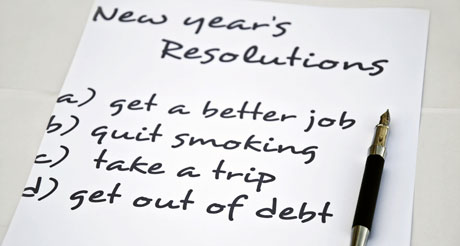

End of each year is the time to reflect on the past 365 days and get ready for new challenges. The best way to get started is to create a plan and a popular way to go is to make a New Year’s resolution. Researchers point out that explicitly stating your goals makes you much more likely to succeed (some research says 10 times more likely). Nearly half of American adults make resolutions but it is unfortunate to learn that only one in five of them sticks to them.

End of each year is the time to reflect on the past 365 days and get ready for new challenges. The best way to get started is to create a plan and a popular way to go is to make a New Year’s resolution. Researchers point out that explicitly stating your goals makes you much more likely to succeed (some research says 10 times more likely). Nearly half of American adults make resolutions but it is unfortunate to learn that only one in five of them sticks to them.

Earning more money or saving more is one of the most popular New Year resolution’s. There is nothing wrong with it; financial independence and success can ignite success in other areas of our lives. But every success requires effort and dedication, not only a wishful thinking. In my opinion, the biggest reason that people fail to reach their annual financial goals is that they get discouraged along the way. That discouragement comes from the fact that they have no real information on how they are doing or the idea how to efficiently collect data, compare, and make decisions. Financial success starts at looking closely at your money coming in and out; once armed with the right information, you can make decisions that will make you more successful.

How to save money more efficiently?

This isn’t a tricky question or even a financial eureka. I just want to reiterate the point with an example so it’ll hopefully make sense for those who struggled with this concept. There are two sides of saving more money: one is making more and the other is saving more, or more appropriate definition, managing money better.

It is impossible to efficiently manage your revenue if you don’t have information on where your money is going. Sure, you pay rent, utilities, gas, etc. These are some categories that you may generally estimate to determine your money outflows, but what about grocery, eating out, lunch, entertainment, or hobby? If you don’t know how much you spend on those categories, you won’t be successful in reaching your financial objectives. Having goals, a plan, and by knowing how much and on what you spend, you can decide what are the best options for increasing your wealth. Perhaps the only solution is working more hours but from experience I know that most people could find spending categories that can be managed better.

How to track you finances?

This depends on how much you want to go into the details and the dedication you want to put into it to get it done. I think the simplest and fastest solution is to take a piece of paper, write down your income stream(s) and major spending categories, and have a box for receipts. As I mentioned before, this requires your effort, minimum a full month of collecting data to have a complete picture. Keep the receipts and enter the information in your budget at your convenience. I suggest making it a habit and doing it once every few days; if you leave it for the end of the month, it’s going to look like too much work and you will be more likely to give up. At the end of the month look at your budget and see what could be done differently? Are there areas where you spend too much? (I bet you will be very surprised). Having insight into those details is what might help you in sticking and fulfilling your New Year’s financial resolution. And if you are already proficient in managing your finances, you might come to conclusion that in order to save more you have to work more.

Final comments

Everybody will have a unique financial situation but they can all be tackled in the similar fashion: by studying details of your accounts and managing them so that they align with your goals. Whether your tools include Excel spreadsheet or Quicken software, they all have merits to help you reach your goals.

Leave a comment